-

HMRC relaxes MTD rules for joint property owners

New HMRC guidance confirms two MTD easements for joint property owners, but a third previously available to self-assessment users is missing. What do you need to know?

-

HMRC deliberately cutting off calls?

The Public Accounts Committee (PAC) has severely criticised HMRC's customer service, forcing it to make a public statement. What's the full story?

-

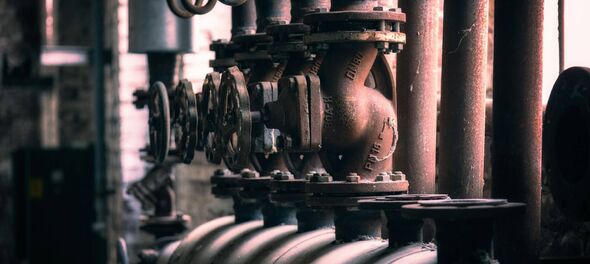

Russian hedge fund manager loses £484k SDLT case

The First Tier Tribunal (FTT) has found that an ex-bacon factory was suitable for use as a dwelling and therefore did not qualify for SDLT relief. What’s the full story?

-

Selling online - what’s HMRC’s latest guidance?

Recently published guidance which suggests that as an online seller you may have to report to HMRC even if you’re selling personal possessions you no longer want. Is this actually true?

-

New disclosure facility for R&D claims launches

A new disclosure facility for companies to rectify inaccurate, historic R&D claims, has been launched. Who might be affected, and how should you use it if you need to?

-

HMRC chief urges thousands to check NI record

In a recent statement HMRC’s chief executive has flagged a problem affecting the NI records of tens of thousands of taxpayers. The trouble concerns anyone entitled to child benefit between 1978 and 2000. What steps are needed to correct the problem?